Mega Fraud Unveiled: ED Targets Business Group in Rs 27,000 Crore Bank Loan Scandal

Mega Fraud Unveiled: ED Targets Business Group in Rs 27,000 Crore Bank Loan Scandal

Introduction: A Financial Scandal Rocks the Entertainment City

Best Casino – The entertainment city, Mega Fraud Unveiled usually buzzing with excitement and glamour, now finds itself in the midst of a massive financial scandal. The Enforcement Directorate (ED) has taken a significant step in a colossal Rs 27,000 crore bank loan fraud case. The agency has attached substantial assets belonging to a prominent business group, including valuable land, shares, and farmhouses. This unprecedented action has sent shockwaves through the financial world and captured the public’s attention.

The Scandal Unfolds: ED Takes Major Action

Details of the Fraud

The Rs 27,000 crore bank loan fraud has been described as one of the largest financial scandals in recent history. Reports reveal that the business group involved allegedly secured massive loans from various banks using fraudulent practices. The loans, intended for business expansion and development, were reportedly diverted for personal gains Birthday Bonus.

In response, the Enforcement Directorate has been investigating the case under the Prevention of Money Laundering Act (PMLA). The investigation uncovered a complex web of deceit, including fake documents, forged signatures, and shell companies. Not only did this fraud involve large sums of money, but it also significantly impacted several banks, resulting in considerable financial and reputational losses.

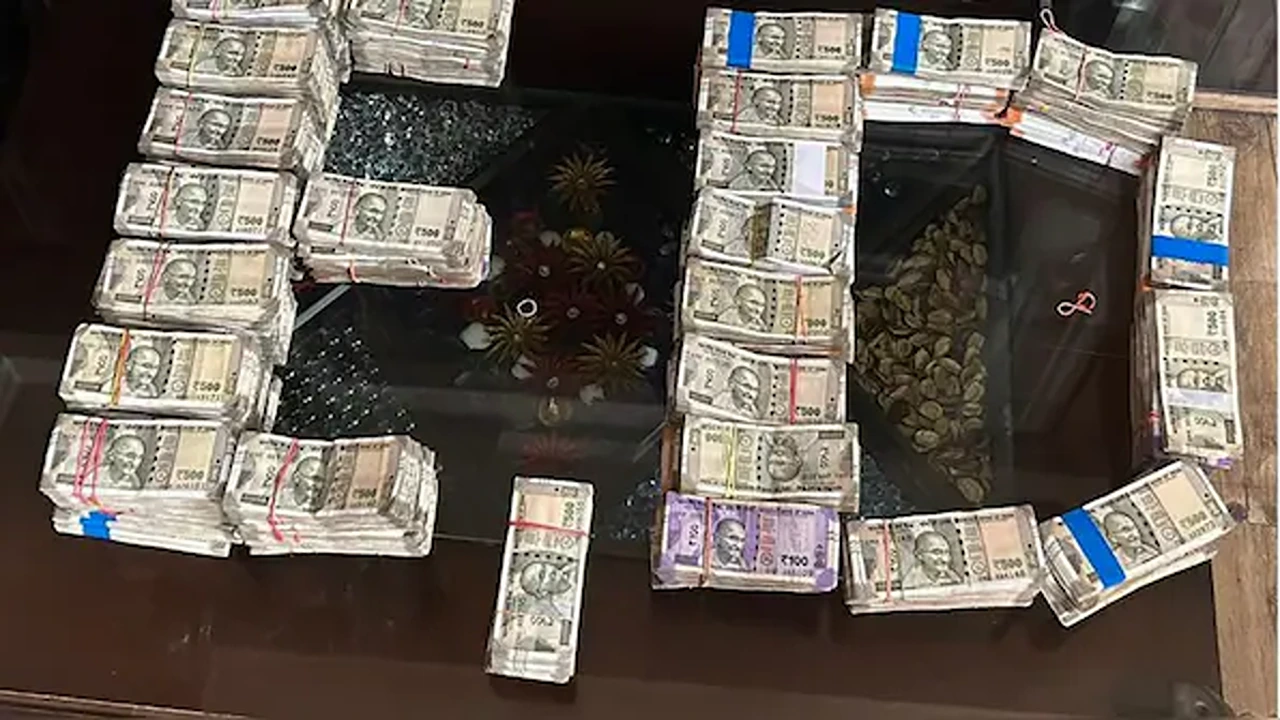

ED’s Asset Attachment

To combat the fraud, the ED has attached key assets of the implicated business group. These assets include prime land holdings, valuable shares, and luxurious farmhouses. The total value of these assets runs into billions, highlighting the scale of the fraudulent activities.

The attachment of these assets is crucial in the ongoing investigation. This action aims to prevent the misuse of ill-gotten wealth and to secure funds that could potentially compensate the defrauded banks. Furthermore, the ED’s decisive action signals its commitment to tackling financial crime and ensuring accountability.

The Impact: Repercussions for the Business Community

Financial and Reputational Damage

The exposure of this massive fraud has resulted in significant financial and reputational damage. The involved banks now face potential losses and a blow to their credibility. Consequently, investor confidence has been shaken, leading to fears of tighter scrutiny of financial transactions and business practices.

Moreover, the business group implicated in the fraud is grappling with severe repercussions. In addition to the immediate loss of assets, the group’s reputation has suffered. This loss of trust could undermine their ability to secure future business deals and financial support.

Broader Implications

Beyond the immediate fallout, the scandal has broader implications for the financial sector and regulatory framework. It underscores the need for stricter controls and enhanced oversight to prevent similar fraudulent activities. Financial institutions may need to bolster their due diligence processes and improve transparency to mitigate the risk of large-scale frauds.

Regulatory bodies might also review and strengthen existing laws and enforcement mechanisms. This review will focus on ensuring that financial crimes are detected and addressed promptly, thereby safeguarding the integrity of the financial system.

Public Reaction: Shock and Outrage

Public Outcry

The revelation of the Rs 27,000 crore fraud has ignited Entertainment City widespread public outrage. People are expressing their shock and frustration through various channels, including social media and public forums. Many are demanding stringent action against the culprits and seeking reassurance that measures will be implemented to prevent future frauds.

The entertainment city, known for its vibrant and engaged populace, has been actively discussing the scandal. Public discourse has centered on the need for accountability and the effectiveness of current regulatory frameworks in addressing financial crimes.

Media Coverage

The media has extensively covered the fraud case, providing detailed reports and analyses. News outlets are focusing on the scale of the fraud, the ED’s actions, and the potential consequences for the implicated business group. This coverage has heightened awareness of the case and kept the public informed about the ongoing developments.

The Road Ahead: Legal and Financial Repercussions

Legal Proceedings

As the investigation progresses, legal proceedings will play a crucial role in addressing the fraud. The implicated individuals and entities will face legal scrutiny, and the judiciary will determine the appropriate course of action. This may include trials, penalties, and other legal measures aimed at ensuring justice and recovering the defrauded amounts.

It will set a precedent for handling similar cases in the future. The legal system’s response will be critical in restoring public confidence in financial and regulatory institutions.

Financial Recovery and Reforms

Recovering the defrauded amounts and restoring the financial system’s integrity will be key priorities. Efforts will focus on securing and liquidating the attached assets to compensate the affected banks. Additionally, the case may prompt reforms in financial regulations and oversight to prevent future occurrences of such large-scale frauds.

The financial sector will need to adapt and strengthen its practices. This adaptation may involve adopting new technologies and methodologies for detecting and preventing fraud. Ultimately, the goal will be to build a more resilient and trustworthy financial system.

Conclusion: A Call for Accountability and Reform

The Rs 27,000 crore bank loan fraud has unveiled a massive scandal that has rocked the entertainment city and beyond. The Enforcement Directorate’s action in attaching significant assets marks a critical step in addressing the fraud and holding the responsible parties accountable.

This scandal highlights the urgent need for stronger regulatory frameworks and more rigorous oversight to protect against financial crimes. As legal proceedings unfold and the financial recovery process begins, the focus must remain on ensuring justice and implementing reforms. The entertainment city remains vigilant, eagerly awaiting further updates and resolution of this App Download high-profile case.